The journey to a comfortable and secure retirement is often described as a marathon, not a sprint. However, the terrain is constantly shifting—marked by volatile markets, evolving tax laws, and the ever-present threat of inflation. For those who want more than just an average retirement—for those who desire a truly plush future—a proactive, strategic approach is essential.

This is where Plush Retirement’s financial advice services stand out. Their goal is to make a clear, personalised plan based on one powerful but often ignored idea: the tax-free retirement plan.The Power of a Tax-Free Retirement Plan

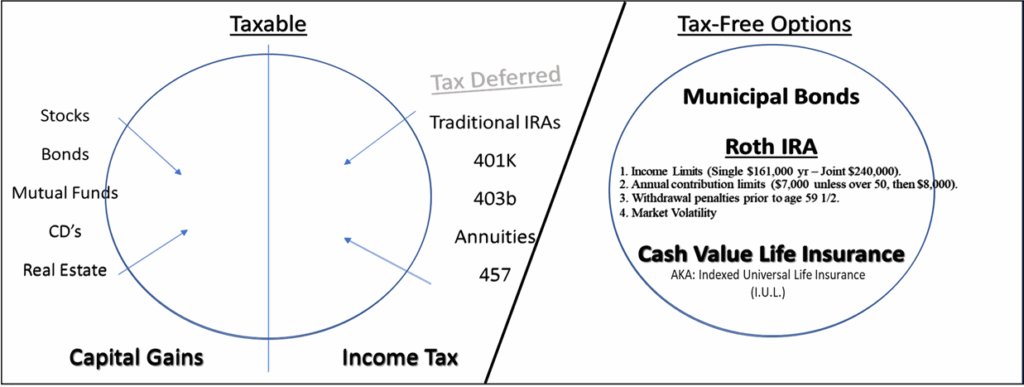

Retirement accounts like 401(k)s and IRAs don’t get rid of taxes; they just put them off. It may seem like a good idea to put off paying taxes during years when you make a lot of money, but many retirees end up paying higher taxes when they take money out.

A tax-free retirement plan changes that paradigm. It allows you to legally structure your wealth so that withdrawals during retirement are completely free from federal income tax.

Plush Retirement emphasises advanced wealth strategies through the PLUSH Retirement Strategy, designed to:

- Generate tax-free retirement income

- Build generational wealth

- Create a lasting legacy.

This strategy often incorporates innovative tools such as Kai-Zen, which can leverage existing financial assets to enhance growth potential while providing tax-advantaged income and essential protections.

By paying taxes upfront or structuring your portfolio around tax-exempt assets, you gain certainty, control, and peace of mind. You safeguard your retirement income from future tax hikes and ensure your wealth supports your family—not the IRS.

Plush Retirement’s focus is on helping you maintain financial independence and ensure your money lasts as long as you do.

The Value of Professional Financial Advising Services

It sounds great to have a retirement plan that doesn’t have to pay taxes, but you need expert financial guidance. To make it happen. That’s where professional financial advising services become indispensable.

An experienced financial advisor does more than just manage your investments. They are also your strategic partner, educator, and accountability partner.

Plush Retirement custom-tailors its financial advising services to fit each client’s unique goals and financial landscape, offering:

Unbiased, Client-First Guidance

Plush Retirement works with multiple financial institutions to make sure that its advice is unbiased. They can focus on safe money options that protect your wealth and lower risk because they are independent. This is very important in today’s unstable economy.

Comprehensive Wealth Protection

Their services go beyond investment management to include:

- Estate planning

- Guaranteed lifetime income solutions

- Life insurance and pension optimisation

For clients with specific pension programs—such as teachers, firefighters, and other public servants—Plush Retirement provides tailored integration strategies that maximise total retirement value.

Empowering Financial Education

Knowledge is power. Plush Retirement believes that an informed client is an empowered client. Using principles like the Rule of 72 (illustrating the impact of compound growth), they help clients understand why early action and disciplined planning are essential.

Their goal isn’t just to handle your money; it’s to help you master your money, building confidence in every decision you make.

Ultimately, engaging professional financial advising services ensures that your retirement plan adapts to changing markets, tax laws, and life events—creating a foundation built for both growth and long-term stability.

Conclusion

A truly plush retirement requires more than just savings; you need a plan. By putting a tax-free retirement plan first and working with Plush Retirement’s financial advisors, you can take charge of your financial future, protect your legacy, and keep your income safe from future tax burdens.

Don’t leave your financial future to chance. Schedule a free 15-minute consultation with a Plush Retirement specialist today and discover how a personalised strategy can help you secure the retirement you deserve.

Frequently Asked Questions (FAQs)

Q1: What is the main goal of the Plush Retirement Strategy?

The main goal is to help clients get tax-free retirement income, build wealth for future generations, and make sure they are financially secure for the rest of their lives, all while avoiding future tax increases.

Q2: What makes Plush Retirement’s financial advice different from other companies’?

Plush Retirement doesn’t push its own products; instead, it works with several companies to create custom solutions, such as safe money strategies and guaranteed lifetime income options.

Q3: Who would benefit the most from a retirement plan that doesn’t tax them?

Anyone worried about taxes going up, inflation, or the risk of living too long can benefit. This method is great for people who want to get the most out of their retirement income while paying the least amount of taxes in the future.

Q4: Is financial advice only for rich people?

No way. Anyone who wants to get their finances in order, make sense of them, and come up with a plan can benefit from financial advice. Plush Retirement advisors can help you with college funding, managing debt, or planning for retirement, no matter how much money you have right now.